In the first 6 months of 2022, 1,120 funding deals were announced, with more than 28.8 billion USD in total investment in the global Crypto (digital currency) market. With the current trends, which direction will the Crypto capital market in the near future develop? Where will be the areas that will attract cash flow from funds and investors?...

According to data from Dovemetrics website and Coin98 Insights team, in the first 6 months of 2022, the average number of fundraising deals in the Crypto market is 186 per month. This number increases gradually from January to April and reaches the highest level. 219 deals in April. In May and June, this number gradually decreased to 214 and 182 deals.

Along with the highest number of deals, in April, the capital raising value also reached the highest peak, reaching $ 6.8 billion. Followed by January with a fundraising value of USD 5.3 billion, February with USD 4.7 billion. By June 2022, the total capital calling value of the market reached $3.6 billion. Overall, while the number of rounds per month is increasing, the value of each round of funding is decreasing.

BLOCKCHAIN, GAMEFI, NFT, METAVERSE ATTRACT INVESTORS

Trends in the market in the first 6 months have shown a correlation between Bitcoin BTC price and cash flow in the fundraising market. A representative of Coin98 commented that, although the Crypto market is being affected by the general macroeconomic, leading to a decrease in the value of investment deals, it still sees many positive points through the number of deals and increases. doubled compared to the same period in 2021 (615 deals) and the value of funding rounds is nearly 3 times (the first half of 2021 is 11 billion USD). The total amount of capital raised and the number of deals in the first 6 months of 2022 is about 30% higher than in the second half of 2021.

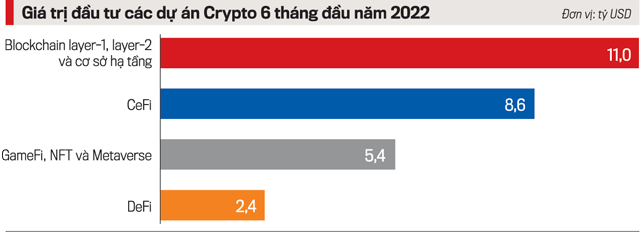

In the first 6 months of 2022, the number of deals in the GameFi, NFT and Metaverse portfolios was 309 (accounting for 27%), while the value of the calls was $5.4 billion (20% of the total market capitalization). ). Therefore, projects in Vietnam, if related to the above list, can still expect to receive healthy capital flows similar to the global market.

Specifically, from January to April is the period when the value of projects tends to decrease, but the number of deals increases steadily, the highest is 219 deals in April, shows that the funds continue to accompany and trust the market. They see this as an opportunity instead of seeing bearish indicators as a negative signal. By May-June, due to the general influence of the macro market, investment capital showed signs of slowing down but not significantly when the number of deals still reached 214 (May) and 182 (June), representative of Coin98 speak.

However, sharing with Vietnam Economic Review / VnEconomy, Tran Xuan Tien, a media representative of Coin98, said that this is not an area where projects in Vietnam focus on benefiting from the number of Layer 1 Blockchain. /layer 2 and blockchain infrastructure in the country do not really account for a high proportion.

Instead, projects in Vietnam are mostly about NFT, Gaming… This portfolio is noted to have received a lot of investments at an early stage. In the first 6 months of 2022, the number of deals in the GameFi, NFT and Metaverse portfolios was 309 deals (27% of the total deals), while the value of those fundraising was 5.4 billion USD (20% of total market capitalization). Therefore, according to Mr. Tien, "projects in Vietnam, if related to the above list, can still expect to receive healthy capital flows similar to the global common market".

Along with Blockchain, the GameFi, NFT and Metaverse sectors receive many early stage investments. In the first six months of 2022, the number of deals in the GameFi, NFT and Metaverse portfolios was 309 deals (27% of the total deals), while the value of those fundraising was 5.4 billion USD (20% of total market capitalization). However, this is a new field, only receiving the attention of the community from the success brought by Axie Infinity. Therefore, despite the large number, there are only a few large deals, most of which are low value, in the early stage (before Series A).

For CeFi (centralized finance) projects, the first half of 2022 has 164 investments with a total value of $8.6 billion. There is 1 investment worth more than 1 billion USD and 25 investments worth more than 100 million USD. The number of projects raised and the value per round in the CeFi portfolio is growing. According to experts, CeFi is a category that receives a lot of attention from funds and large investors.

Meanwhile, DeFi (decentralized finance) is receiving little interest and money from funds and large investors, although it is the most attractive category in 2021. Average size of each The investment round in the DeFi portfolio is about 10 million USD, much lower than the market in general (about 25 million USD) and CeFi in particular (50 million USD). Total funding in the DeFi portfolio is $2.4 billion, with 229 investments, representing 9% and 20% of the total fundraising market, respectively.

FORECAST THE NUMBER OF CAPITAL DEPOSIT AND VALUE WILL DECREASE

Through the numbers, data collected and analyzed, experts commented, the cash flow into the market in the first half of 2022 is gradually decreasing compared to the second half of 2021 (only 842 deals with a total value of . $22.6 billion).

On the side of investment funds, the average size of each fund round is 500 million USD, much higher than the second half of 2021. More and more funds are raising capital to invest more in the Crypto market. has shown signs of incessant cash flow into the cryptocurrency market.

Based on the current state of the market, experts predict, in the second half of 2022, the total number of fundraising deals and their value will decrease due to market conditions. The field of CeFi, Blockchain and infrastructure will continue to receive a lot of attention from investors.

The DeFi sector will reduce the number of rounds but GameFi and NFTs new projects can still attract early investors to invest in the early stages (seed, pre-seed) of project.

It is forecasted that in the last 6 months of 2022, the total number of fundraising deals and the value will decrease due to market conditions. The field of CeFi, Blockchain and infrastructure will continue to receive a lot of attention from investors.

For investment funds, from the end of 2021 to now, many large investment funds have called for huge capital. Therefore, from now until the end of the year, funds will face pressure to make investments. The frequency and quality of deals will still be guaranteed; thereby creating positive value for the whole market. However, macroeconomic influences can still affect the overall situation.

Sharing this issue, Mr. Cris D. Tran, Executive Director of Vietnam National Startup Fund, Strategic Director of Huobi Global Group in Vietnam, said that when the market is downtrend, it will greatly affect the funds. investment because they will have to review their portfolio system, save money, and choose projects.

Particularly for the Vietnamese market, Mr. Tien said that it will continue to be under the general influence of the global market. Global capital is flowing into the infrastructure-focused Crypto market. This is a long-term investment because the project team needs time to use capital and develop products. The healthy level of capital flow is very good, suitable for projects that need time to perfect the product.

Meanwhile, fields related to end users are Vietnam's strengths such as NFT, Gaming, and Metaverse which are expected to create a new wave if there is an application that is well received by users. However, the difficulty is still finding users. In the Uptrend market, it is easier for users to decide to participate in investment and experience. When the market is downtrend, users will be quite cautious when making decisions. However, the "sweet fruits from DeFi Summer" promise to help the market in the second half of 2022 become more vibrant and attract more users, Tien forecast.